NPS PPF Investment AssetAllocation TaxBenefits LongTermInvesting MarketVolatility Liquidity

In the landscape of financial planning, selecting the right investment avenue can be a daunting task. Two popular options that often find themselves in the spotlight are the National Pension System (NPS) and the Public Provident Fund (PPF). Both offer attractive features and benefits, but understanding their differences is crucial in making an informed decision. In this comprehensive guide, we'll delve into the intricacies of NPS and PPF, dissecting their key features, benefits, and drawbacks to determine which option might be better suited for your investment goals.

Understanding NPS: A Gateway to Retirement Planning

The National Pension System (NPS) is a government-sponsored retirement savings scheme designed to provide financial security during one's post-retirement years. It operates on a defined contribution basis, wherein individuals contribute regularly towards their retirement fund, which is then invested in various asset classes such as equities, corporate bonds, and government securities. NPS offers flexibility in investment choices and tax benefits under Section 80C and Section 80CCD(1B) of the Income Tax Act.

Decoding PPF: A Time-Tested Instrument for Long-Term Wealth Creation

The Public Provident Fund (PPF) is a tax-saving investment scheme offered by the government of India. It is known for its safety, stability, and attractive interest rates. PPF operates as a long-term savings instrument with a lock-in period of 15 years, during which investors can make regular contributions and earn tax-free returns. Additionally, PPF offers the dual benefit of tax deduction under Section 80C and tax-exempt interest income.

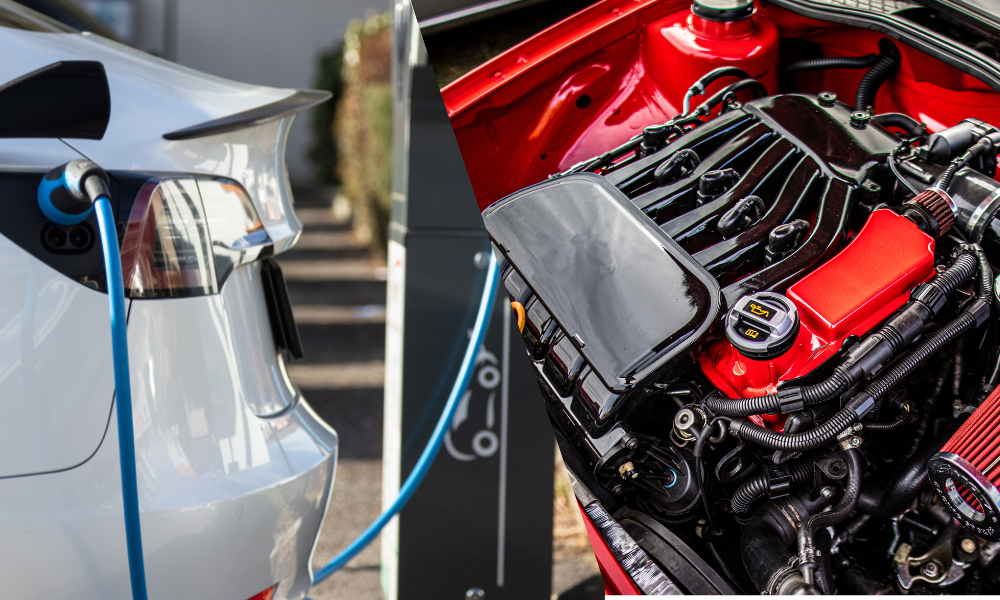

Comparing NPS and PPF: Key Differentiators

-

Objective: NPS primarily focuses on retirement planning, offering flexibility in investment choices and the potential for higher returns through exposure to equity markets. On the other hand, PPF serves as a long-term savings instrument with a fixed interest rate, catering to individuals seeking stability and tax-saving benefits.

-

Lock-in Period: While both NPS and PPF come with a lock-in period, they differ in duration. NPS has a longer lock-in period, extending until retirement age, whereas PPF has a fixed lock-in period of 15 years.

-

Tax Benefits: Both NPS and PPF offer tax benefits under Section 80C of the Income Tax Act. Additionally, NPS provides an exclusive tax benefit under Section 80CCD(1B), allowing for an additional deduction of up to ₹50,000 over and above the Section 80C limit.

-

Return Potential: NPS has the potential to generate higher returns over the long term, given its exposure to equity markets. However, returns in NPS are market-linked and subject to market fluctuations. PPF, on the other hand, offers fixed and tax-free returns, making it a more conservative option.

-

Withdrawal Flexibility: NPS offers partial withdrawal options for specific purposes such as education, marriage, or purchasing a house, subject to certain conditions. In contrast, PPF allows for partial withdrawals from the 7th year onwards, providing liquidity to investors.

Making the Choice: Which Option is Better for Investment?

The decision between NPS and PPF depends on various factors such as risk tolerance, investment horizon, financial goals, and tax planning needs. Here's a simplified guide to help you make an informed choice:

-

Choose NPS If:

- You prioritize long-term wealth accumulation and retirement planning.

- You are comfortable with market-linked returns and potential fluctuations.

- You seek additional tax benefits beyond the Section 80C limit.

- You value flexibility in investment choices and withdrawal options.

-

Choose PPF If:

- You prefer stable and guaranteed returns over the long term.

- You are risk-averse and prioritize capital preservation.

- You seek tax-saving benefits with assured tax-free returns.

- You are comfortable with the fixed lock-in period of 15 years.

Tailoring Your Investment Strategy

In the realm of financial planning, there's no one-size-fits-all solution. Both NPS and PPF offer unique features and benefits, catering to diverse investor preferences and objectives. Ultimately, the choice between NPS and PPF depends on your individual financial goals, risk appetite, and tax planning needs. By carefully evaluating the key differences and aligning them with your investment strategy, you can embark on a path towards financial security and prosperity.

Powered by: Oh! Puhleeez Branding Agency & NowUpskill

NPS PPF Investment AssetAllocation TaxBenefits LongTermInvesting MarketVolatility Liquidity