Bootstrapping, Venture Capital, Startup Funding, Entrepreneurship, Business Strategy

Launching a startup is an exciting endeavor, but one of the most critical challenges entrepreneurs face is securing funding to turn their vision into reality. Two primary methods for funding startups are bootstrapping and venture capital (VC) investment. In this blog post, we'll explore the differences between these two approaches, their respective advantages and disadvantages, and the key considerations for entrepreneurs when choosing their funding strategy.

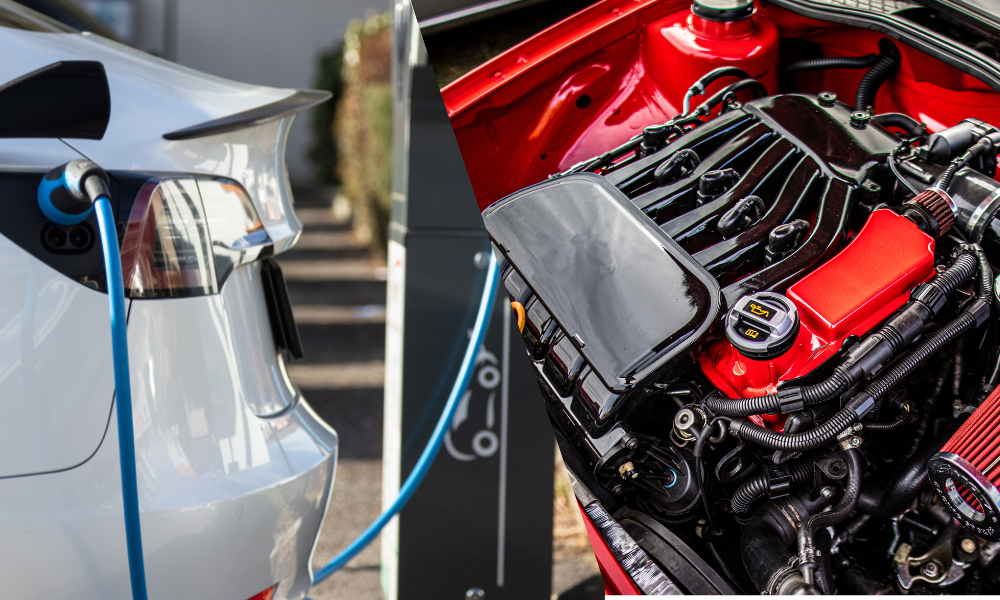

Bootstrapping: Building from the Ground Up Bootstrapping involves funding a startup using personal savings, revenue generated from early sales, or loans from friends and family. Entrepreneurs who bootstrap their startups retain full ownership and control, allowing them to make decisions independently and pivot quickly in response to market feedback. Bootstrapping fosters resourcefulness and discipline, as founders must prioritize spending and focus on generating revenue from the outset. However, bootstrapping may limit the scalability and growth potential of a startup due to constrained resources and slower initial progress.

Venture Capital: Accelerating Growth with External Investment Venture capital involves raising capital from investors in exchange for equity in the startup. VC funding provides startups with significant capital infusion, enabling rapid growth, market expansion, and product development. Venture capitalists often bring expertise, industry connections, and strategic guidance to the table, helping startups navigate challenges and capitalize on opportunities. However, securing VC funding typically requires relinquishing a portion of ownership and may involve pressure to achieve aggressive growth targets within a specified timeframe. Additionally, VC-backed startups face heightened scrutiny and accountability from investors.

Key Considerations for Entrepreneurs:

-

Growth Objectives: Entrepreneurs should assess their growth objectives and timeline to determine the most suitable funding strategy. VC funding may be appropriate for startups aiming for rapid scalability and market dominance, while bootstrapping may be preferable for those seeking more gradual growth and autonomy.

-

Risk Tolerance: Bootstrapping entails less financial risk for founders, as they are not beholden to external investors and can operate within their means. Conversely, VC funding carries the risk of dilution and potential loss of control, as investors may influence strategic decisions and the direction of the startup.

-

Market Dynamics: The competitive landscape and industry dynamics can influence the feasibility of bootstrapping versus seeking VC funding. Startups in rapidly evolving industries with high capital requirements may benefit from VC investment to gain a competitive edge and capture market share.

-

Founder Vision: Founders' personal preferences, values, and long-term vision for the startup play a significant role in determining the funding strategy. Some entrepreneurs prioritize independence and self-reliance, favoring bootstrapping, while others are willing to trade ownership for the opportunity to scale rapidly with VC backing.

Bootstrapping and venture capital represent two distinct paths for funding startups, each with its pros and cons. While bootstrapping offers autonomy, control, and financial discipline, VC funding provides access to capital, expertise, and accelerated growth opportunities. Ultimately, the choice between bootstrapping and venture capital hinges on factors such as growth objectives, risk tolerance, market dynamics, and founder vision. By carefully weighing these considerations, entrepreneurs can chart a course that aligns with their goals and maximizes their startup's chances of success.

Powered by: Oh! Puhleeez Branding Agency & NowUpskill

Bootstrapping, Venture Capital, Startup Funding, Entrepreneurship, Business Strategy